#Banktivity pricing update

These reports update automatically and render in the easy to comprehend and to grasp forms of tables, bar graphs, and even pie charts. This powerful, simple to use, and quick interface lets you develop instantaneous spreadsheets and reports. If that is still not enough to impress you, Banktivity makes available all of this data that you require in only a few clicks. These deliver single glance and fully customizable snapshots of your different individual accounts sorted according to the type of account they represent. We also like the all new account summary pages. We are sufficiently impressed by the Banktivity dashboard that displays a substantial amount of important financial metrics such as account and credit card balances, statement of net worth, deposits and bills that are coming, recent spending habit categories, budgeting information, rate of personal savings, and most importantly information about your investments.

#Banktivity pricing software

Intuit has dominated this niche of the personal financial management software for years, but this has changed thanks to the introduction of the much-improved Banktivity. With the arrival of Banktivity, we are pleased to see that you can effectively follow your finances and transactions as well as stock portfolios, and make budgets and create reports that all work together to assist you in efficiently analyzing and rating your own present day and future finances. The latest version of this product is a significant improvement over the previous version, which was referred to as “iBank 4” before the company's name change. Besides the Mac/iOS version of Quicken, there is another program that competes for the needs of Apple's Macintosh and iPhone/iPad users. The number of choices for them are few and far between. Mac and iOS users have been largely left out of the proliferation of good programs in the personal financial management space in the past. (Note: As of January 2016, the company formerly known as “iBank” has rebranded as “Banktivity”. It is still a good choice, however, especially if you can't connect using either of the methods above.Download Our 2023 Precious Metals IRA Investor’s Guide. Although Banktivity offers an integrated web browser to make this easier, this method does require the most steps.

#Banktivity pricing download

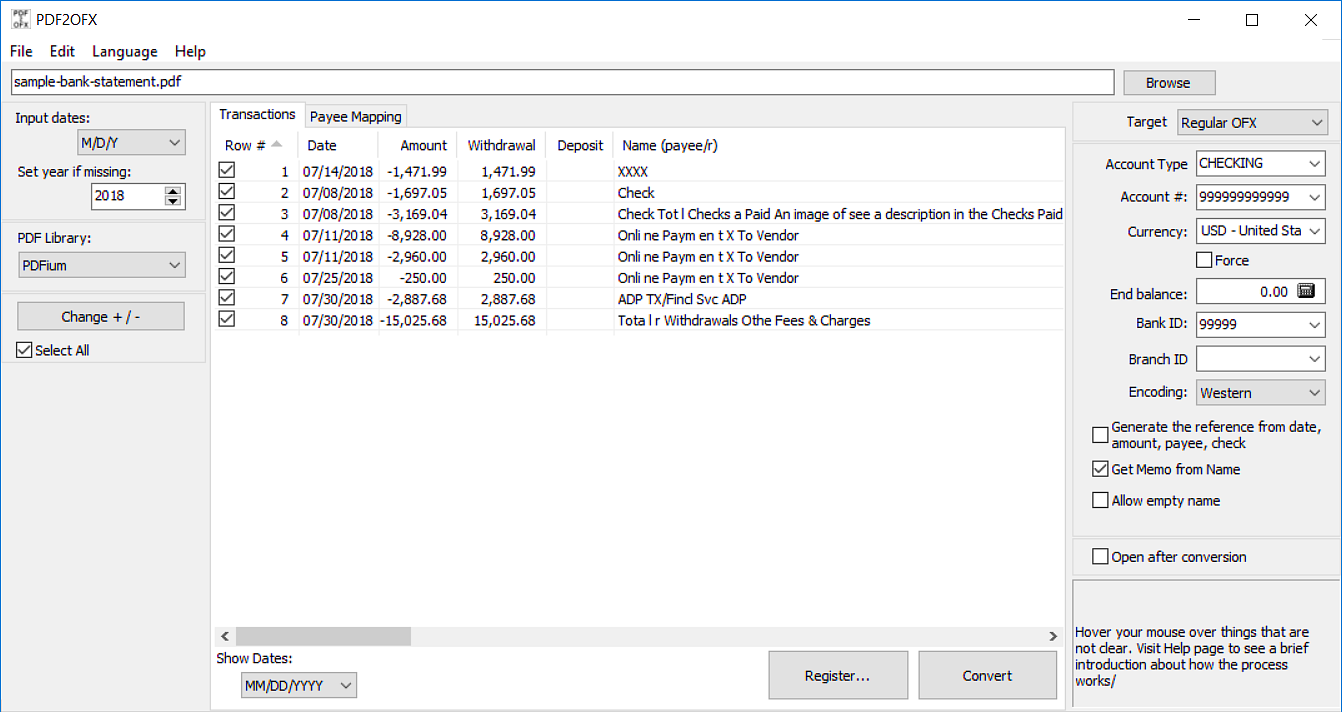

Web Download works by you downloading a file from your bank's website and importing it in to Banktivity. Web Download is the least automated way to get your data in to Banktivity. We don't have any control over which banks support it, and banks often charge their customers to use this service. Direct Download (OFX)ĭirect Download (OFX) is another automated way to connect to your banks, but support for this method varies by bank. Also, one subscription to Direct Access allows you to connect from all your Macs, iPads, and iPhones. This service has a small fee, but allows you to connect to the largest list of banks. The easiest way to connect is by using our optional Direct Access service. There are three ways to get transactions from your bank into Banktivity. Whenever you set up an account in Banktivity you'll be able to choose how you want to connect. Banktivity can automatically connect to over 10,000 banks – so getting your accounts and transactions into Banktivity has never been easier.

0 kommentar(er)

0 kommentar(er)